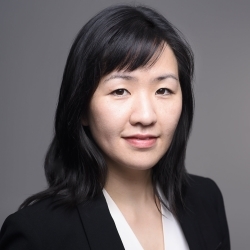

Crystal Wong

Phone

Office Location

I have been working in the financial services industry since 2006, with a focus on fostering strong client relationships and helping customers achieve their personal financial goals. I hold a Bachelors degree in Economics from The University of British Columbia. I also hold the CERTIFIED FINANCIAL PLANNER™ certification offered by the Financial Planning Standards Council. I look forward to working with you.

Certificates

FMA

CFP®

Languages

Cantonese

Mandarin

Frequently asked questions

What does a financial planner do?

What to expect at my first meeting?

What are the steps in financial planning?

Your Unique Goals

Knowing that you have a plan for tomorrow will help you concentrate on getting more out of life — today.

TD Wealth Financial Planning

Your priorities are important to us. We can work together towards your goals, and can help with:

TDAM: Tax & Retirement Planning Guide

At TD Asset Management Inc. (TDAM), we understand the importance of tax planning to investors. There are many tax-efficient investment vehicles available to Canadians to help maximize after-tax income and grow their investment portfolios.

退休迷思:五个传统观念

关于退休有很多老生常谈的观念。然而,其中许多想法早就应该被淘汰了。这里有一些关于您应该如何退休的最新见解。

Asian Segment

Whether you are new to Canada or established Asian Canadians, we have colleagues who understand your unique financial needs, and the tools and resources to help you with your real estate lending, investment solutions, retirement planning, estate and trust planning, as well as philanthropic giving, business expansion, succession, and tax planning.

Women and Investing

Helping achieve what truly matters to you and your family.

Build net worth: We can help you build your net worth by developing effective strategies and investment solutions that align to your needs, even as they evolve.

Protect what matters: By leveraging the expertise of TD specialists, we can integrate strategies to help you protect what matters to you most at every life stage.

Implement tax-efficient strategies: We can work with you to help create and structure your accounts to help reduce tax exposure while keeping income available for when you need it.

Leave a legacy: Your legacy is important to us. We’ll help you create a plan that provides for your top priorities and optimizes the transfer of your wealth.

Lynn – The Gift of Planning

When experiencing a difficult situation and looking for financial security, finding the right advisor can be a critical step toward making it easier. TD Wealth helped Lynn’s dad make sure everything was in place for when he was gone.

Lynn believes in the value of planning, as her father worked with TD Wealth to prepare his finances and plan for the future of his daughter, making a very difficult life experience easier.

Contact me today to find out how I can help you feel reassured in your financial future.

Trending Articles

Stay informed and enhance your investment knowledge with our curated articles on the latest news, strategies and insights.

Money Mismatch: 4 ideas to manage your money and your relationship

Article

Money Mismatch: 4 ideas to manage your money and your relationship

More than half of Canadians surveyed say they would break up over a partner's spending habits. Here's why some planning and flexibility can be the foundation of a great money partnership.

2026 resolutions: 4 things you can do now to improve your fiscal fitness

Article

2026 resolutions: 4 things you can do now to improve your fiscal fitness

Starting the new year on the right foot, financially, may be easier than you think. Are you ready to strengthen your wealth building muscle? Here are four ways to get your money doing some of the heavy lifting.

3 questions snowbirds should ask before taking flight

Article

3 questions snowbirds should ask before taking flight

The annual migration may look a little different for Canadian snowbirds this year. Whether you're still planning or already packing, here are three items to double-check before heading abroad for an extended period.