When interest rates move lower, you may wonder how your finances will be impacted, both now and in the future. What does it mean for people with mortgages, savers or the recently retired? Nicole Ewing, Director, Tax and Estate Planning, TD Wealth, joins Kim Parlee with some ideas to help manage the changing environment.

Raising a family can put all kinds of pressure on your time and money. Here are a few pointers to help you navigate the “crunch,” so you can be better prepared for the future.

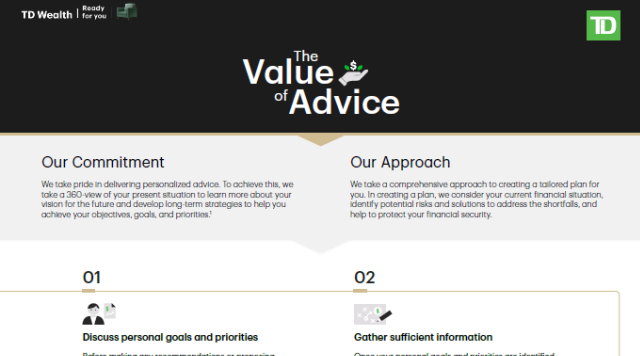

We take pride in delivering personalized advice. To achieve this, we take a 360-view of your present situation to learn more about your vision for the future and develop long-term strategies to help you achieve your objectives, goals, and priorities.

Many people know at least a little about RRSPs. But what about RRIFs? If you’re in or nearing retirement, are you ready to begin the big conversion? Here’s a quick guide to the world of RRIFs.

There are lots of well-worn thoughts on retirement. Unfortunately, many of these ideas should have been retired a long time ago. Here are some up-to-date ideas on how you should approach retirement.

Leaving a lasting legacy for your family can involve careful planning and a team of professionals. Here are five questions that can help get you started.

Too many Canadians are dying without a Will, leaving children, heirs and assets in limbo. Here’s why you should consider writing your own will today.