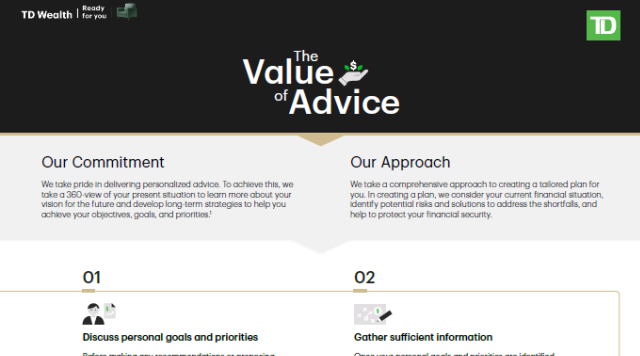

We take pride in delivering personalized advice. To achieve this, we take a 360-view of your present situation to learn more about your vision for the future and develop long-term strategies to help you achieve your objectives, goals, and priorities.

Raising a family can put all kinds of pressure on your time and money. Here are a few pointers to help you navigate the “crunch,” so you can be better prepared for the future.

There are lots of well-worn thoughts on retirement. Unfortunately, many of these ideas should have been retired a long time ago. Here are some up-to-date ideas on how you should approach retirement.

If retirement is on the horizon, but it feels like there's still so much to do, feel free to take a breath. This checklist may help alleviate some of your worries.

For couples who meet later in life, retirement planning may seem a little daunting. But it doesn’t have to be. If you get started now, and ask the right questions along the way, it can even be exciting. Here are a few questions that should be top of mind.

Many people know at least a little about RRSPs. But what about RRIFs? If you’re in or nearing retirement, are you ready to begin the big conversion? Here’s a quick guide to the world of RRIFs.

Most couples will face a knotty financial problem that will test their love for each other. If arguing about money is upsetting a great relationship, here are some things to consider.

Got the travel bug again, but unsure where to start? Consider one of these epic adventures — any of which can be tailored to your budget and style.

Too many Canadians are dying without a Will, leaving children, heirs and assets in limbo. Here’s why you should consider writing your own will today.

Leaving a lasting legacy for your family can involve careful planning and a team of professionals. Here are five questions that can help get you started.

Stepfamilies are common, but planning for who gets what after you die is anything but routine. When families come together, each with their own possessions, ensuring your assets go where you want is key.

Many parents want to help their kids buy a first home. Is this a good idea, and if so, what’s the best way to do it?

Many people dream of a life free of worries in their golden years. Yet some find themselves anxious and depressed when that abrupt change comes. Here are some planning tips to help make your retirement days truly golden.

Whether through luck or longevity, many Canadians nearing retirement are living in homes that may be worth double what they paid for them 10 or 20 years ago. Even with recent dips in the market, these paper millionaires may be asking themselves: Should I stay or should I go?

Q: My dad is in his 70s and has mentioned moving in with his new girlfriend. Should we be concerned about protecting his assets if the relationship gains common-law status?

Is there a difference in your rights and responsibilities between common-law and married couples? It may be a good idea to find out before you shack up.

Financial scams and fraud come in many different forms. Sometimes they arrive in the form of a text message, email, or phone call, and often these forms for fraudulent communications are designed to look like they are coming from your bank.